For many of us who have just been launched into the working lives immediately after graduation, answering to societal pressure is not what we look forward to. Does spending a lot of money bring in more happiness? Is bragging about a large swanky place in the city centre worth the debt loan amount? Societal pressure is something you cannot control. However, you do want to remember, you are responsible and have to live your own decisions. Your neighbours or relatives will not be the ones paying out your mortgages.

Let’s talk about the housing situation. Buying a house is likely to be the largest purchase you would make. Most people have to borrow money to finance it. Here are two intriguing stories that will get you thinking:

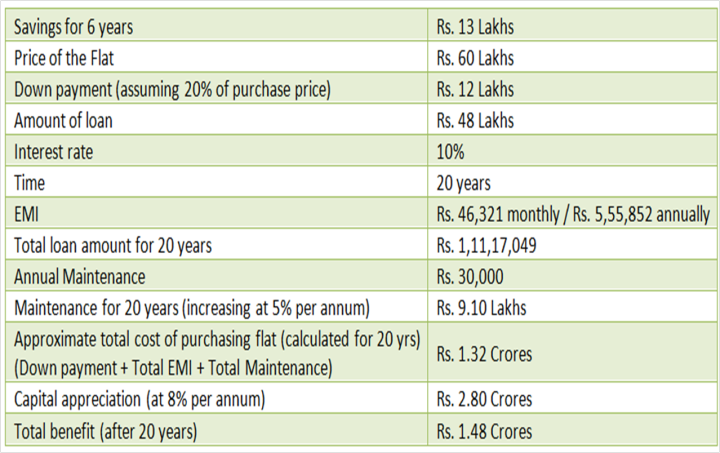

Case 1: Samir: When the flat is purchased

Samir started his first job in 2004 in Mumbai. He saved a good amount annually and invested a part of his savings in various financial instruments over the first two years. In 2010, his neighbours and friends insisted that he should buy a house instead of paying rent every month. Originally from Bangalore, Samir had grown to love Mumbai city. He definitely had no plans of shifting to new city or going back to Bangalore. The idea was appealing and he could not get his mind off about how he would convert the place into his dream house. Confident that it was the right thing to do, Samir bought a house in Mumbai. He was aware of the additional responsibilities that came along with buying the house. This included the high down payment cost, legal fees, mortgage, insurance, taxes, and maintenance costs. Nevertheless, Samir was prepared. He considered this opportunity as an investment for the future. He even thought that this would be like running your own business. Despite the risks and high costs, Samir went ahead and bought the house. He was satisfied with the benefits of the investments.

Case 2: Riya: When the flat is rented

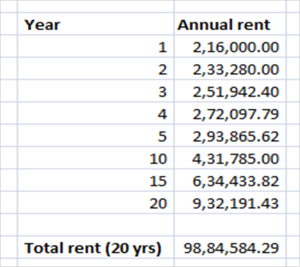

Riya, a classmate of Samir, got job in Mumbai. She enjoyed her freedom to move homes whenever she wanted. She had no plans to settle in once place. She was happy she didn’t have to pay for the high down payment amount that came with buying a house. She could use the money for her other goals. Riya knows that she does not have to worry about maintenance and monthly EMIs. She had also invested her savings that now amounted to Rs. 13 Lakhs after last 6 years.

Annual rent to be paid: Rs. 2,16,000 (increasing at 6% per annum)

Instead of paying the annual EMI and maintenance charges of Rs. 9 Lakhs per annum (approx), Riya prefers renting a place and investing the remaining Rs. 6 to 7 Lakhs in mutual funds that earn 8% per annum. After 20 years, she saves approximately Rs. 2 Crores (excluding her earlier savings of Rs. 13 Lakhs).

The Complications:

By now, I am sure most of you would now be thinking about your next step! Excited are we? Do you remember the hare and the tortoise story? We can apply the same logic here. Don’t run too fast, or you may miss some crucial aspects that could lead to unexpected financial problems. Confused?

Here is what Samir and Riya would need to have considered before taking the final decisions:

– Cost of living and monthly expenses:

EMIs and rent amount should not exceed more than 40% of your salary. This would affect the monthly expenses and other cash outflows. Think: Would you be able to meet your monthly expense requirements after considering the EMI?

– Lifestyle:

Where we spend our money and the way we spend our money matters. Money from savings is what many consider as a way to finance their houses. Think: Are you willing to live a less lavishing life to start saving for the monthly EMIs if required for over a long period?

– Future:

The future of the individual and the family needs to be considered. Think: Are you planning to get married? Or are you already married and planning to have a child? An increased family member would mean more costs and financial commitments. Will other financial commitments leave you enough to pay for the monthly EMIs?

– Family members influence:

Discussing your decisions and taking an opinion from family members is important. Think: Will your spouse, parents or in-laws be happy with this decision?

– Unexpected events:

Accidents, illnesses, or unemployment comes unexpectedly. Having an emergency fund is essential. Think: Suppose due to recession, the company decides to lay you off. Would you be able to sustain on your savings for the next 4-5 months and pay your EMI at the same time?

– Goals:

The most crucial element in financial planning is thinking about your goals. Think: Can your other goals wait? Or would buying a car or perhaps taking a sabbatical be more critical? Despite buying a house, would I be able to save for other goals?

Think. Research. Plan. Then Act accordingly. If it’s possible, go ahead.

Conclusion:

Looking at the cases of Samir and Riya, you know that when buying a flat in a city like Mumbai, where housing markets appreciate with a minimum of 8% per annum, you will definitely earn a return on your investment. This option is best for those who are willing to stay in one place over a long time. If you are the kind of person who doesn’t want to be committed to one place, perhaps because of job opportunities or may not be willing to take a huge step, renting is definitely a good stop. Of course, you would need to invest the rest of your savings like how Riya had done, to benefit from the situation. It all depends on the level of commitment and responsibility you are willing to take and not the fact that your friendly neighbour says that it is about time you bought a house. The power of compounding is your new best friend. Listen to it, and take decisions accordingly.

0 Comments