A credit card is an amazing invention in the financial industry that can turn out to be a friend or perhaps a foe.

What is a credit card?

A credit card is a payment system through a plastic card. It is an agreement that allows an individual to borrow money for purchases or cash advances.

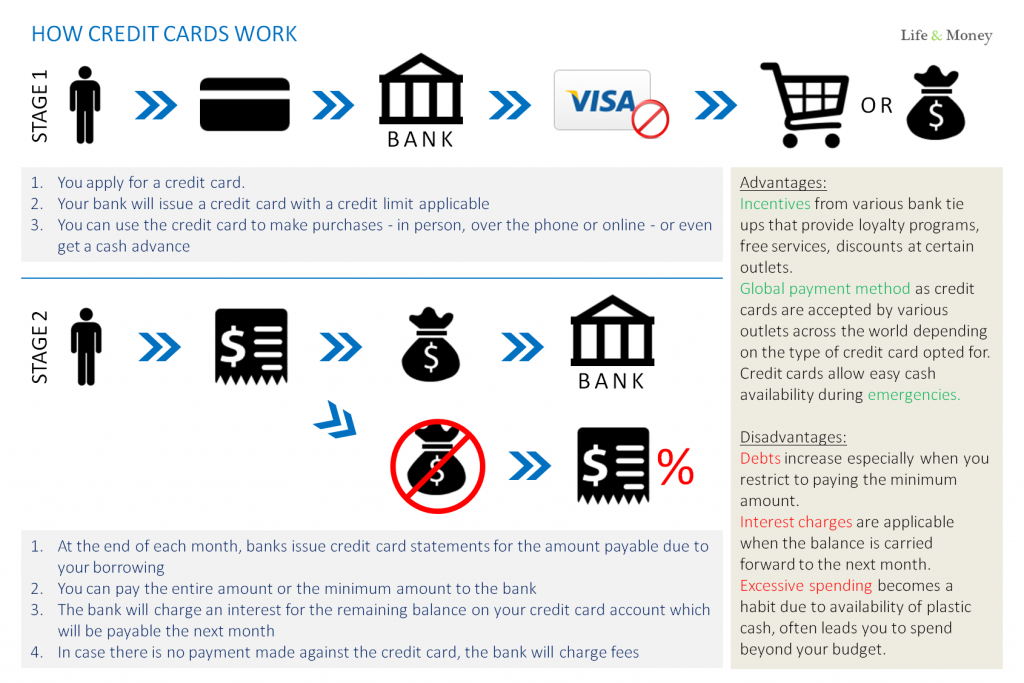

How do credit cards work?

(Click image to view larger and clearer infographic)

When you receive the credit card from your bank, you will be informed of a credit limit. This is the maximum amount for which you can get a cash advance or make a purchase for goods and services.

A credit card is a fast and convenient payment method for everyday purchases that can be made in person, over the phone or online.

A credit card also allows you to withdraw cash against your credit card account. This is known as the cash advance option.

Each month, the bank sends you a statement that gives the details of transactions made over the month. The statement mentions:

- The credit limit

- Available credit

- Minimum payment amount and due date

- Interest charged, if any, on the previous balance

You should always aim to pay off more than the minimum repayment amount. If you pay the minimum amount each time, it will take you longer to pay the balance and you will be charged an interest. The interest can accumulate over a period and become an expenditure that you were not looking forward to in your budget. You could have instead spent the money elsewhere.

A credit card is a tool that must be used wisely. Like a sword, it can help (through easy availability of cash) and yet it can cut and bleed your budget (excessive spending and increased debt). Has the financial sword been your friend or foe?

0 Comments