At some point of time during investments, we would have heard the terms “bull market” and “bear market.” How well aware are you of these terms?

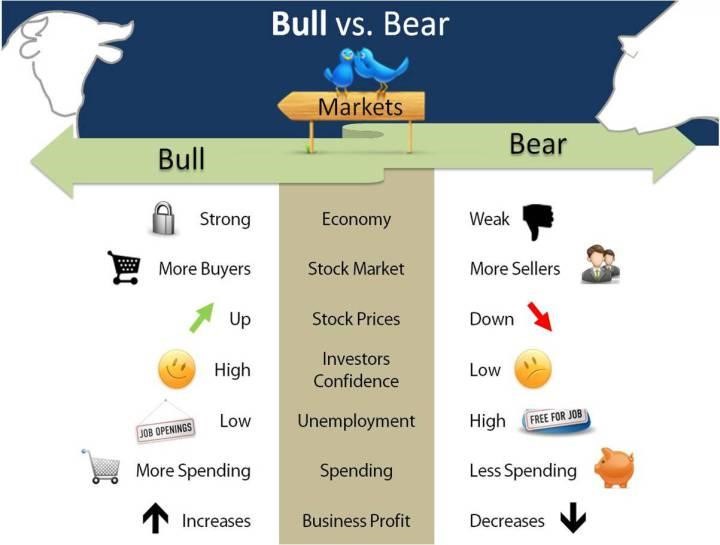

The bull market is identified as that market in which there is a rise in prices in the securities market whereas the bear market describes a sluggish securities market.

Bull markets are easy to understand. Picking a stock from this market is a rosy affair because everything goes up! But then a rising market can’t last forever. On the other hand, many find bear markets tough to understand. A solution to making profits during this time could be short selling or waiting until the bear market ends.

Over the last decades, stock markets have always risen over the long term. Despite the bull market ascending followed by stock market crashes, the market comes back to normal and eventually rises to a higher value than before.

Many investors tend to determine their investments based on the bearish or bullish market, and generally prefer investing when the markets turn from a bear to a bull. Professional investors claim this to be unwise. The best way to base your investments would be to research into strong businesses that have a potential to grow. By carelessly selecting investment options, you are bound to have sleepless nights due to the risks that come with rumours, fear, and guesswork.

Researched, educated, and informed investment decisions tend to profit more over a period. Being conservative is always a plus point. Jumping into something you do not understand is what you want to stop yourself from doing. After all Warren Buffet says, “Only buy something that you’d be perfectly happy to hold if the market shut down for ten years.”

0 Comments