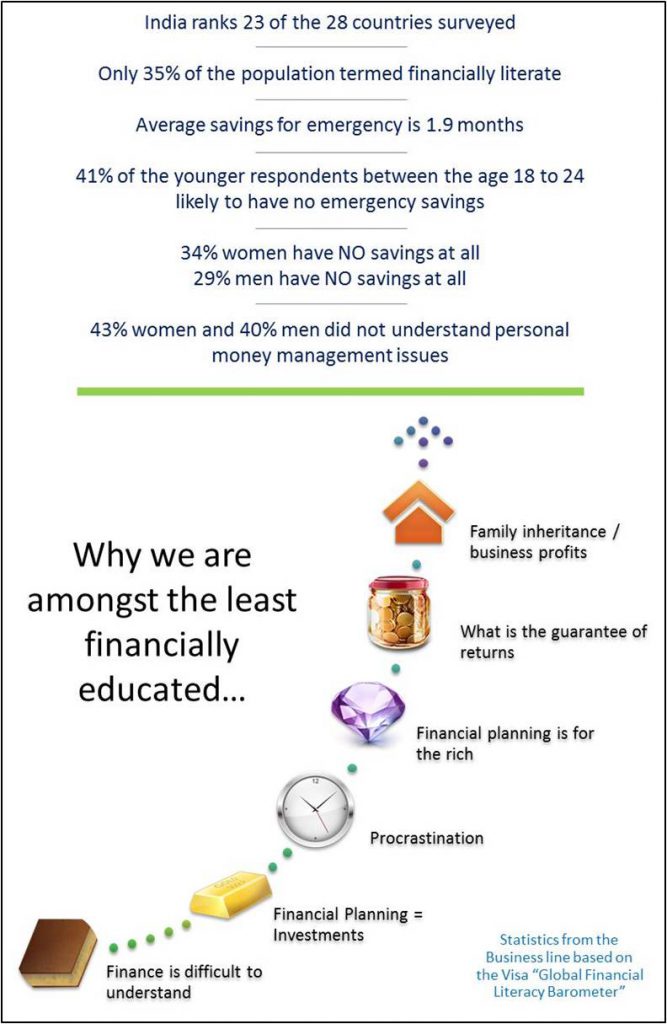

Surprisingly yes! In a recent research conducted by Visa, India was ranked 23 out of the 28 countries surveyed on the financial literacy platform. And it is even more alarming to see that women and youth are struggling financially.

Why are we ranked so low?

Here are some reasons that I believe, tend to push us back on the financial literacy front:

1.Believing that finance is difficult to understand

Gone are the days where you would have to go to public libraries or attend classes to understand those huge words in the big books of finance. We have Google, Newspapers, Magazines, family and friends. Take out a few minutes each day. Browse the internet or the business section of a newspaper. There is A LOT of information. There are many websites that provide short videos or articles that can give an overview of the subject. It’s not difficult! What do you discuss over a meal with family and friends – movies, gossips or fashion? Spare a few minutes and talk about every day money management, financial transactions, etc. It’s the best way to learn.

“Anyone who stops learning is old, whether at twenty or eighty. Anyone who keeps learning stays young. The greatest thing in life is to keep your mind young.”

– Henry Ford

2.Financial Planning = Investments

Finance doesn’t stop with the income you get at the end of every month and the amount you deposit for investments or in gold. There is more. Money management, debt management, retirement planning, family planning, savings, future values of money and risk profiles are some important factors to be included.

3.Being a procrastinator

If you think that daily cash management or future planning isn’t important right now and that there are much better things to be engaged in – you are wrong. Time has value and delays will only increase expenses. Set aside some time each day to plan your goals, your future financial requirements and priorities – it won’t take long. Saying that you don’t have time, won’t get you anywhere either. The equation of time can be seen below:

Time = Money

Increase in Delays or Time = Increase in Cost of Achieving Goals

4.Thinking that financial planning is for the rich

Every individual requires financial planning. It is a basic requirement to attain financial security. It is not necessary to go to a financial planner to sort out your future financially. With a little learning, you can set your own financial plans.

5. Family inheritance or your own business is enough for survival

Don’t count on your inheritance money or the prospects of business profits. The future is always uncertain. And businesses have a risk factor. Step out of your comfort bubble. You never know when this might come in handy.

6. What is the guarantee of returns?

The guarantee of returns is based on the level of risk you opt for. Low risk tolerance means a larger guarantee but a lower return. If you are not sure about various financial instruments and investment options, seek help of a financial adviser. Today is not the day to fall back on what you have. Learn and gain more knowledge…it’s the first step towards attaining a better financial future and increased wealth. Plan now and enjoy later.

Really surprising..!!! Indians who are really good at savings but least educated financially.