You are a fresher from college and got a job in a nice company. You are excited about it and you catch up with your neighbor on the way home. What if your conversation is something like what Lionel and Marian are having!

Sounds Impossible!

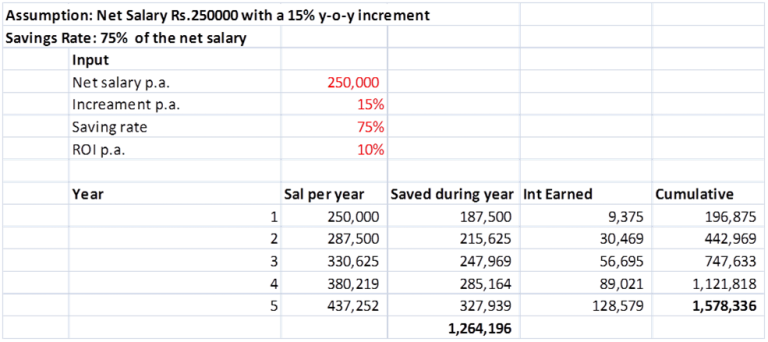

Not really. If you could follow the conversation, the key focus is saving 75% of your income every month to attain your goals in 5 years. What do you think will be the amount that you can save in the next 5 years? Let us assume you earn a net income of Rs.2,50,000, with a 15% increment per annum and the return on investment on your savings is assumed at 10%.

The cumulative amount in 5 years could help fund your housing need in an upcoming suburb or your town with margin money to the extent of 25% as well as purchase a nice small new car from your balance savings. As someone said, Smaller House and a Smaller Car helps you to focus on ‘Experiences’ in Life. What do you think?

The inspiration for this blog post came from one of the Authors Erik Carter I have been following for the last 2 years. In one of his blogs he had written about how to be financially independent in 5 years! He in turn has credited it to a blog he follows regularly.

0 Comments