The following blog is by Carl Richards originally published in The New York Times’ Blog.

Few things will humble parents faster than when they realize they’ve made some dumb assumptions about their children. And twice in the last few weeks, my own children have shown me where I’ve gone wrong when it comes to teaching them about money.

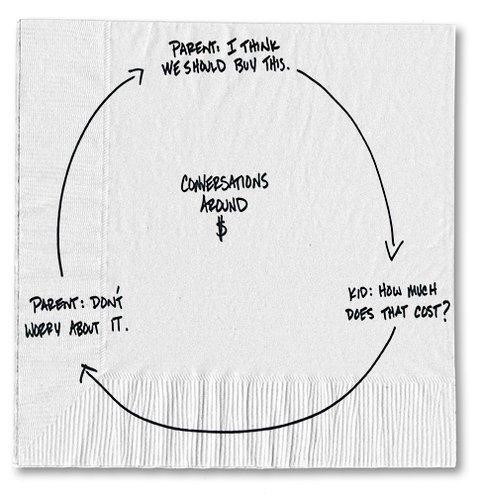

I thought my wife and I were covering all the bases. We have talked aboutbudgeting. We have talked about saving. We’ve even talked about why we made certain financial decisions. But guess what we never really talked about? Numbers.

You’ve probably done it, too. Let’s say your children know that you’re buying a new car. You probably wouldn’t talk to them about how much it cost. After all, they could mention the number to your neighbors, and you wouldn’t want that to happen. So, here’s what I learned from my children. Hopefully, my own experience will help you have better conversations with your own children, as well as your spouse, or anyone else that you share financial decisions with.

1) Don’t hide the numbers

One Saturday afternoon, I decided to stop at the boat shop. I have fond memories of long summer days at the lake, and I wanted to see what it might cost to buy a boat for our family. The fact that we don’t really need a boat probably explains what happened next. But since I was feeling a little sheepish about the whole “needs versus wants” subject, I hid the price tag when my son asked me how much the boat cost. And I compounded the mistake by making up some funny number, like 54 quarters, to try to throw him off.

I should have shown my son the price and explained: 1) why a boat costs that much; 2) why I think it’s worth that much money; and 3) how we saved as a family over the previous years to afford it (should we decide to buy it). In short, I would have helped my son put the buying decision into context, which leads me to the next lesson.

2) Don’t assume your children think the same as you

One of the best parts about being a parent is getting to watch my children make decisions and try new things. Little did I know that my daughter’s decision to explore soccer would be a lesson for my wife and me. After attending the orientation meeting, my daughter came home and explained what she’d learned, and my wife asked her about the costs to play.

My daughter replied “$20,000,” with just a slight hint of caution.

After seeing my wife’s shocked expression, she was quick to assure her mom that it covered two uniforms and an assortment of other things for the entire season. But, and I think you can see where I’m going, my daughter hadn’t made the connection between the crazy number and what she thought she was getting in return.

To be clear, the disconnect isn’t because we’re a family who uses money as paper towels. And our children know what it means to earn a few dollars doing chores. They have savings accounts. They have an allowance. But it appears that we haven’t taken the time to give my daughter a point of reference for a number as large as $20,000. Because a number this large was unfamiliar, and because she had never played soccer before, she didn’t have any real context to help her understand why it didn’t make any sense at all.

As it turns out, $20,000 was actually the budget for the entire team for the entire season. The cost per player was closer to 1/10th of that number. But my daughter’s experience made it perfectly clear that we had dropped the ball.

So, the next time you’re talking with your children, your spouse or anyone else about money, please make sure that you’re talking about the same thing. Don’t avoid talking about the numbers or the price. And please don’t make the same mistake I did, and assume that it’s not worth having a conversation that gets specific. Based on these experiences, I’m convinced that there would be fewer money issues in our families if we worried less about what people thought and more about what our families know.

I want each of my children to know what things cost so they can weigh the pros and cons of buying this versus buying that. I want my kids to understand just how much money $20,000 is so that they can make a fair judgment about the worth of something compared to what they’re getting in return. And perhaps most important of all, I don’t want my discomfort to stop me from providing my kids with the skills and information they need to make smart money decisions.

I bet you want the same things for your children, too.

About the author: For the last 15 years, Carl Richards has been writing and drawing about the relationship between emotion and money to help make investing easier for the average investor. His first book, “Behavior Gap: Simple Ways to Stop Doing Dumb Things With Money,” was published by Penguin/Portfolio in January 2012. Carl is the director of investor education at BAM Advisor Services. His sketches can be found at behaviorgap.com, and he also contributes to the New York Times Bucks Blog and Morningstar Advisor. You can now buy – “The Behavior Gap” by Carl Richard’s at AMAZON.

0 Comments