You know what’s worse than judging a book by its cover? Judging a book by its cover, and then making financial decisions based on what you assume the book might tell you.

Here in New Zealand, where I’m spending the next year, you don’t see many fancy cars. In fact, I kind of forgot they existed. So the other day, when I pulled into the church parking lot with my family and saw a brand-new $150,000 Range Rover, I couldn’t help but stare. “Huh,” I thought, “looks like somebody has rich parents.”

I felt bad immediately. What do I know? Maybe that guy (or gal — another assumption) is just a really hard worker. Maybe it’s a rental. Maybe the driver is a chauffeur.

I was telling my friend Joe about the experience. He’s a rock climber and a proud, self-described “dirtbag.” Joe lives in an old, dilapidated, perpetually broken-down van. As I told him the story, I didn’t expect him to relate. Joe doesn’t seem to care at all about material things.

“Oh, dude,” he told me, “I know exactly how you feel! That’s like the other day when I pulled up to the climbing cliff, and I saw this fancy Dodge ProMaster in the parking lot.” For climbers, a ProMaster is the Rolls-Royce of vans. When Joe saw it, he had a knee-jerk reaction. “I immediately thought, ‘Pshaw, trust-funder.’”

It surprised me that even Joe couldn’t help comparing himself to the Joneses. I never got a chance to see who was driving the Range Rover. But Joe ended up talking to the owner of the ProMaster and found out the guy works construction and is often away from home for two-week gigs. He receives a stipend for travel, room and board.

Joe realized that if the man pocketed the stipend, it would be enough to cover the payments on the van and the food he cooked inside it. So, the guy is not a trust-funder after all, just a smart, blue-collar worker.

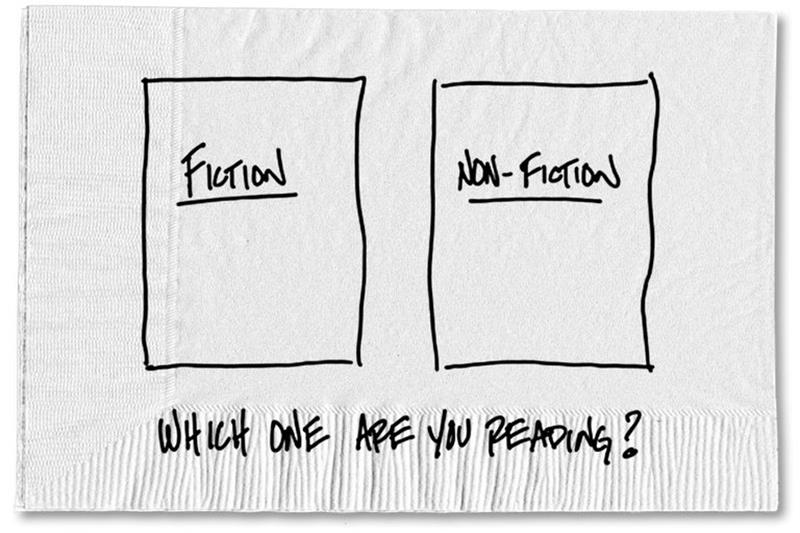

I know you’re thinking, “Yes, Carl, we know about assumptions. What’s the point?” The point is that not only do we have a habit of telling ourselves fiction about the people around us based on outward appearances, we also allow those stories to inform how we spend our money.

A smart economist named James Duesenberry studied this phenomenon and named it the relative income hypothesis. According to Mr. Duesenberry, people tend to save less “because the higher spending of others kindles aspirations they find difficult to meet.” He also argued that “the high standard enjoyed by a formerly prosperous family … constitutes a frame of reference that makes cutbacks difficult.”

Just think about that for a second. We base our decisions about how we spend our money on how we think our income compares with those around us and what we’ve spent in the past. But unless our neighbors have shared their tax returns, we don’t know their real income. Our financial decisions could easily be based entirely on fiction. So I’m going to take some creative liberties and rename this phenomenon the Relative Guess How Much I Make Hypothesis.

As we roll into annual consumption season, it’s a good time to test this hypothesis. As you gather for holiday meals, notice the stories you tell yourself about the person who bought and cooked the organic, free-range turkey. Let your mind wander into stories of trust funds, annual bonuses or the credit-card debt they must have racked up.

Then, call yourself on it. Notice the stories. Admit to yourself that you are a storyteller of really great fiction, and when it comes to money, you’re a judgmental storyteller. Then, step back. Remember that everyone does it, and take a minute to remind yourself of the facts as you know them. It’s a turkey. It’s good. The rest is just fiction.

And since consumption season is followed by resolution season, I have a suggestion for your first two New Year’s resolutions. Stop making assumptions about things you don’t actually know and definitely stop spending based on those assumptions. The best part? You don’t need to wait until New Year’s Day to start.

The above blog is by Carl Richards originally published in The New York Times’ Blog.

About the author: For the last 15 years, Carl Richards has been writing and drawing about the relationship between emotion and money to help make investing easier for the average investor. His first book, “Behavior Gap: Simple Ways to Stop Doing Dumb Things With Money,” was published by Penguin/Portfolio in January 2012. Carl is the director of investor education at BAM Advisor Services. His sketches can be found at behaviorgap.com, and he also contributes to the New York Times Bucks Blog and Morningstar Advisor. You can now buy – “The Behavior Gap” by Carl Richard’s at AMAZON.

0 Comments