The following blog is by Carl Richards originally published in The New York Times’ Blog.

When I say “risk” and you say “risk,” chances are high we don’t mean the same thing.

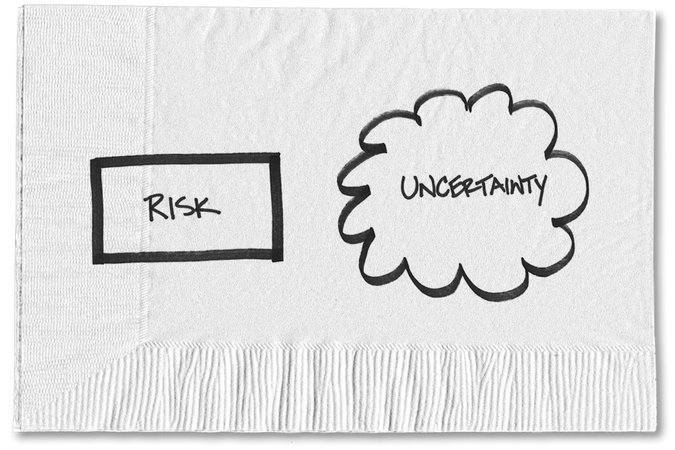

The finance industry defines risk as something measurable. It is variability within a set of known limits. You may have heard it referred to as standard deviation or even volatility. Ultimately, it represents how much an investment wiggles over time.

I’m an adviser who talks to humans. I also happen to be human. From my experience, I know humans outside the financial world define risk differently. In everyday life, we tend to think of risk as uncertainty, or what is left over after we have thought of everything else.

With uncertainty comes variability within a set of unknown limits. It’s the stuff that comes out of left field, like Nassim Nicholas Taleb’s black swan events. Because we can’t measure uncertainty with any sort of accuracy, we think of risk as something outside our control. We often connect it to things like running out of money in retirement or ending up in a car crash.

But how did we end up with two such completely different definitions of the same thing? My research points to an economist named Frank Knight and his book “Risk, Uncertainty and Profit.”

In 1921, Mr. Knight wrote: “There is a fundamental distinction between the reward for taking a known risk and that for assuming a risk whose value itself is not known.” When a risk is known, it is “easily converted into an effective certainty,” while “true uncertainty,” as Knight called it, is “not susceptible to measurement.”

This difference in definitions may seem like a small thing, except that it leads to two different sets of expectations. When expectations are not met, the result can be bad behavior. In this case, bad investment behavior.

Imagine for a moment that it is 2005. You have completed the kind of risk tolerance questionnaire that financial advisers often ask you to fill out before recommending investments. You then sign off on a portfolio based on your answers, comfortable that you are taking the perfect amount of risk. Then, one morning, you wake up. It’s 2008, and the markets are in free fall. The risk that felt just right three short years ago doesn’t feel so right anymore, and you sell everything.

I’m betting that the level of risk you agreed to in 2005 did not mentally translate into all of the wiggling that took place in 2008. I’m also betting that if you heard a term like “risk management model,” you really thought, “uncertainty management model.” Unfortunately, no financial firm offers uncertainty management.

Solving this problem doesn’t require a new definition. We just need to shift our thinking when we hear someone in finance mention risk. We need to remember, that person isn’t talking about the odds we’ll lose everything, but about something that fits in a box.

I suspect that is why financial professionals sound so confident when they talk about managing our risk. In their minds, managing risk comes down to a formula they can fine-tune on their Dial-A-Risk meter. In our minds, we have to learn to separate the formula from the unknown unknowns that cannot be accounted for in any model or equation.

Once we learn to recognize that we are not talking about the same thing, we can avoid terrible disappointment and bad behavior when financial risk shows up again. And it will.

About the author: For the last 15 years, Carl Richards has been writing and drawing about the relationship between emotion and money to help make investing easier for the average investor. His first book, “Behavior Gap: Simple Ways to Stop Doing Dumb Things With Money,” was published by Penguin/Portfolio in January 2012. Carl is the director of investor education at BAM Advisor Services. His sketches can be found at behaviorgap.com, and he also contributes to the New York Times Bucks Blog and Morningstar Advisor. You can now buy – “The Behavior Gap” by Carl Richard’s at AMAZON.

0 Comments