The following blog is by Carl Richards originally published in The New York Times’ Blog.

For more than a decade, my family and I have gone to Jackson Lake in Wyoming for what’s become our favorite summer vacation. Because the trip includes a boat, we make arrangements to rent a mooring for the boat so we don’t have to take it in and out of the water each day.

Last week, I overheard my wife on the phone making the reservation for the mooring. As I listened, I noticed she didn’t ask how much it cost. When I asked her why, she replied: “Does it matter?”

“Of course it matters,” I said, “It’s not like money grows on trees around here.” She patiently reminded me that we’ve had this discussion every year we’ve gone on this trip. We had budgeted to cover the cost, and it’s stayed roughly the same for years. In other words, we have already made this decision.

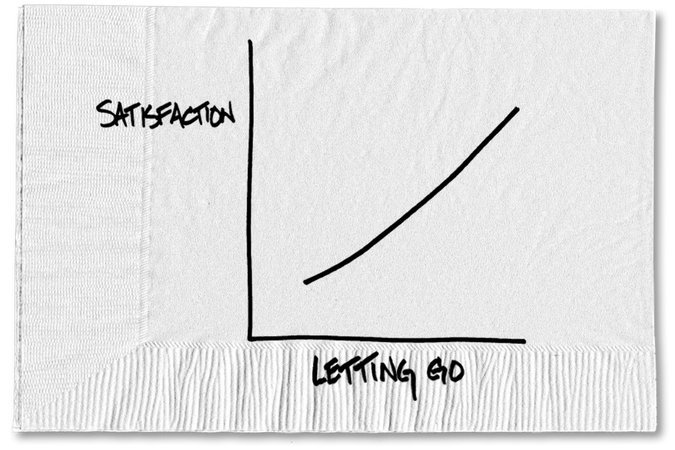

In less than 10 seconds, my wife reminded me of a valuable lesson. When we’ve already planned, saved and weighed the pros and cons, we’re wasting both time and emotional capital revisiting buying decisions. It’s one of the biggest drivers of buyers’ remorse, and creates conflict around money that doesn’t need to exist.

There are so many other decisions in our life that we’re shortchanging if we’re unwilling to let go of the decisions we’ve already made. For instance, keeping the boat in the water doesn’t just make our vacation a little bit better. It makes it a lot better. It allows us to enjoy every day on the lake and skip the time drain of wrestling the boat in and out of the water. It’s money well spent, and while I know it logically, it can be hard to fight my emotional reaction to not knowing the exact price.

I’m not the only one who struggles with this issue. It even comes up when making regular, everyday buying decisions. The classic example has to be the guy who drives all over town looking for the cheapest gas. The math is easy, and, logically, he knows he’ll save less than $5, but he still spends the time and gas to look for the “best deal.” Between the driving time and fuel cost, he probably spends way more than he saves.

Why not spend the time comparing the prices of the gas stations that are convenient and decide that’s where you’ll fill up every time? Make the decision once, then let go of thinking about the fact that you just might find gas 5 cents cheaper. Remember that on 20 gallons that saves you only a dollar!

Then there are the people who believe the best way to spend (or save) money is to do everything themselves. A friend of mine is buying a boat this summer. He lives near a lake and will probably be on the water three or four days a week. During our conversation about his purchase, my friend mentioned he didn’t believe in spending time wiping down the boat every time he pulled it out of the water.

If you own a boat, you probably know there’s a process that many follow after being on the water. You spray the boat with a product to reduce hard water spots, and then wipe it down. The process takes time, and if you multiply it by three or four outings a week, it adds up. On top of the time, the solution you spray on the boat costs money. My friend had a different plan.

At the end of each season, he’ll take the boat to a detailer who’ll clean it and get it ready for storage. He figured out the costs, and between the materials and time required to clean the boat himself after each trip, his end-of-season cleanup will be about the same price, and is just as good, if not better, for the boat.

It’s very easy to convince ourselves that somehow the money is better spent if we do something ourselves versus pay someone else to do it. In this case, my friend made it about the numbers, and he feels O.K. spending the money because he’s planned, saved and weighed the pros and cons ahead of time.

You probably know at least one person in your life who drags out every money decision and revisits it to the nth degree (you may even be that person). Does this approach lead to measurably better money decisions or does it just seem like they’re better decisions?

There’s no need to beat ourselves up every time we spend money. So here’s the only trick I know for letting go. Always make it a point to discuss, plan and, if needed, save. Then, when you spend, embrace the knowledge that you’ve done the work beforehand so you know it’s money well spent. It’s a small thing that can mean the difference between finding financial balance or being trapped in financial misery.

About the author: For the last 15 years, Carl Richards has been writing and drawing about the relationship between emotion and money to help make investing easier for the average investor. His first book, “Behavior Gap: Simple Ways to Stop Doing Dumb Things With Money,” was published by Penguin/Portfolio in January 2012. Carl is the director of investor education at BAM Advisor Services. His sketches can be found at behaviorgap.com, and he also contributes to the New York Times Bucks Blog and Morningstar Advisor. You can now buy – “The Behavior Gap” by Carl Richard’s at AMAZON.

0 Comments