The following blog is by Carl Richards originally published in The New York Times’ Blog.

Investors were stung, badly, by the financial crisis of 2008. No one wants to go through an experience like that again, which has led to renewed interest in an investing approach called tactical asset allocation.

These tactical strategies have been around for years, and their claim is simple: The tactical manager or mutual fund retains the flexibility to move quickly among different types of stocks, bonds and cash so the manager can participate in market upswings while avoiding much of the pain on the downside.

Traditional, rock-star fund managers usually claim they can pick the best individual stocks, but tactical managers make a different promise. They are not interested in finding the best individual stock or bond. Instead, they offer some supersecret, black-box algorithm that can analyze macroeconomic forecasts and valuation formulas to identify the ideal time to get in and out of broad asset classes like stocks and bonds.

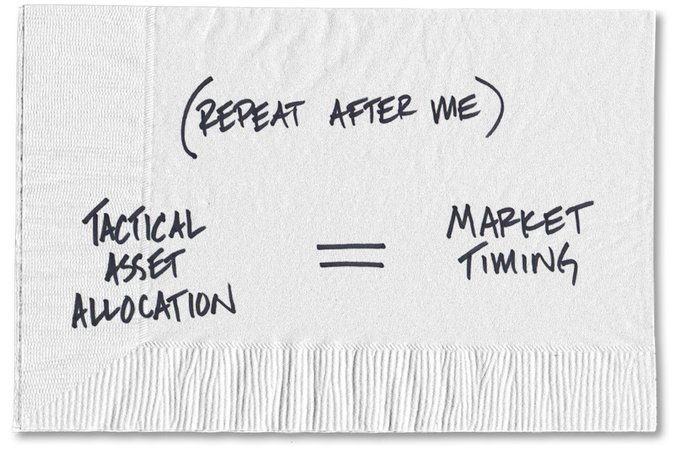

Let’s be clear: This is nothing more than market timing. It’s a fancy way of saying, “We plan on being in stocks when they’re going up, and we plan to get out just before they go down.”

Of course, that’s a wonderful promise. That’s what all of us want, really — if we could only buy low and sell high.

The problem is, none of us knows exactly when these turning points will happen. Nobody rings a bell right before the market goes down, and nobody rings a bell to say, “Hey, get in,” right before the market goes back up. No matter how complex your forecasts or how big your spreadsheets, tactical asset allocation strategies are just market timing by a fancy — and very expensive — name.

If you’ve ever tried to time the market, you know firsthand how hard it is. And past research shows us that traditional market timing doesn’t work. In 1994, John R. Graham and Campbell R. Harvey published a paper that analyzed the advice of 237 investments newsletters.

“We find that over 75% of the newsletters produce negative abnormal returns. Some recommendations are remarkably poor. For example, the (once) high profile Granville Market Letter-Traders produced an average annual loss of 5.4% over the last 13 years. This compares to a 15.9% average annual gain on the Standard & Poor’s 500-stock index.” (Joseph Granville died last year.)

But what about this new breed of fancy market timers? Are they any more successful?

Fortunately, in February 2012, the research company Morningstar decided to update a previous study of tactical asset allocation funds. While this update added only 17 months of data to the original study, it was an ideal time to check on the performance of these funds, because the new period covered the rally of 2010, a sharp correction and the continuation of a rally again.

To demonstrate whether tactical asset allocation funds were able to deliver on their promise during this volatile period, Morningstar compared the results of 210 tactical asset allocation funds against the performance of a simple default investment choice, the Vanguard Balanced Index Fund. This fund has a fixed allocation of 60 percent stocks and 40 percent bonds, and the managers make no attempt to change that allocation based on the direction they think markets are headed.

So how did these 210 fancy market-timing funds perform against a diversified, very low-cost choice that anyone can own? Well, the study didn’t tell us anything we didn’t already know:

“We found that tactical funds generally struggled to deliver competitive risk-adjusted returns when compared with a traditional balanced fund. With a few exceptions, they gained less, were more volatile, or were subject to just as much downside risk as a 60 percent-40 percent mix of U.S. stocks and bonds.”

When we actually look at the results instead of the marketing claims of these funds, it turns out that tactical asset allocation is just like market timing — because just like market timing, it doesn’t work.

Believe me, you’d be better off if you stopped trying to time the markets and just stuck to a simple strategy of picking a low-cost, balanced fund, like the Vanguard Balanced Index Fund, and holding on to it.

Now, in case you’re not a big fan of research, here are a few succinct quotes about the value of market timing.

“The only value of stock forecasters is to make fortunetellers look good.” — Warren E. Buffett

“A decade of results throws cold water on the notion that strategists exhibit any special ability to time the markets.” — The Wall Street Journal

“Far more money has been lost by investors preparing for corrections, or trying to anticipate corrections, than has been lost in corrections themselves.” — Peter Lynch

“Whenever some analyst seems to know what he’s talking about, remember that pigs will fly before he’ll ever release a full list of his past forecasts, including the bloopers.” — Jason Zweig

“Let’s say it clearly: No one knows where the market is going — experts or novices, soothsayers or astrologers. That’s the simple truth.”— Fortune

Don’t get me wrong, it’s only human to find the promise of market timing so appealing. It seems so obvious in hindsight. When we look back, we can see clearly that we all should have been selling stocks in 2007 and buying them again in 2009. But if you go back to that time period, the facts show that most of us weren’t, because we didn’t know at the time that we’d reached the peak or the bottom. That’s the reality.

Still, there will always be this temptation to believe that we can get into an asset class when it’s going up and get out before it heads south. So we have to keep reminding ourselves that, while it’s not impossible, it’s highly improbable we’ll be able to do it successfully over a long investing horizon. Why not just take the simple, balanced choice and get on with your life?

About the author: For the last 15 years, Carl Richards has been writing and drawing about the relationship between emotion and money to help make investing easier for the average investor. His first book, “Behavior Gap: Simple Ways to Stop Doing Dumb Things With Money,” was published by Penguin/Portfolio in January 2012. Carl is the director of investor education at BAM Advisor Services. His sketches can be found at behaviorgap.com, and he also contributes to the New York Times Bucks Blog and Morningstar Advisor. You can now buy – “The Behavior Gap” by Carl Richard’s at AMAZON.

0 Comments