The following blog is by Carl Richards originally published in The New York Times’ Blog.

Almost 10 years ago, I knew a guy on a financial rocket ship. He had a great house, a successful business and a solid income.

But then things changed. With the benefit of hindsight, it was clear he bought a little too much house and spent a little too much money. At the beginning, he was rewarded for buying the house. Its value went up a lot in a short time. For context, imagine Florida, Arizona or Las Vegas in 2006-7. Houses were selling even before hitting the official market and for way more than the asking price.

Things continued to go well for this guy, and he decided to borrow money against the equity in his home to start a new business. But not long after, the rocket ship ran out of fuel.

The value of his home dropped. In fact, the house eventually was worth less than what he paid for it. Then, his income dropped significantly because his business was tied closely to the local economy.

Again, with the benefit of hindsight, this story looks like a series of obvious mistakes. And to his credit, this guy took full responsibility for every one of those decisions. Along the way, he dealt with mental and physical stress while trying to juggle the web of consequences arising from this experience.

I imagine you can relate personally to this story or know someone who can. Given our history of booms and busts over the last 15 years, you’ve probably watched some version of this story play out more than once.

Now fast-forward a couple of years. This guy had a bunch of stuff go well in his life. He now has superpositive net worth. His relationships are better than ever. He has taken steps to avoid repeating earlier mistakes.

I share this story because I am that guy. I have asked myself over and over, “What did I do wrong to deserve the bad experience?” And then more recently, “What did I do right to deserve the good experience?”

Notice how loaded the language is, with the emphasis on whether and when I was deserving.

Over a series of conversations with a friend, I talked through my story and realized I could only identify the mistakes I made with the benefit of hindsight. As is often the case, it is very easy to look backward and make up stories about why certain things happened and then take either the blame or the credit for them. The reality of life is often a bit more nuanced. As I carefully reflect on the good and the bad experiences, I have come to the conclusion that, in both cases, I was simply doing the best I could with the knowledge and experience I had at the time.

But when we look back at our stories, we need to be careful. Because, as I told my friend, “I can’t define exactly what I did to deserve the bad stuff or to deserve the good stuff.”

Based on my past experiences, I reasoned with my friend, “If you fast-forward five years, I could end up homeless or own a private jet, or anything in between.” This friend, who happens to be a life coach, replied, “Yeah, and if you can get yourself to accept that, you’ll finally be free.”

It took me awhile to understand what he meant. But I realized he was talking about the freedom we feel when we let go of the idea that we “deserve” any specific outcome.

We’re certainly not free of personal responsibility. But consider the people who say they believe they can control their future. They tell themselves the story that if they just plan carefully enough, they can achieve certainty about what will happen.

For years, many of us have believed this myth. In reality, life is irreducibly uncertain. That doesn’t make us more or less successful or more or less happy. The true joy in life, the real peace, comes when we let go of the idea that we deserve a predetermined happy ending.

Of course, we’re going to have a goal on the horizon, and we’ll head toward it. But we may wake up tomorrow and say, “I’m not sure that’s the best direction to go anymore.” We then need to ask ourselves if things have changed, or if our goal just feels too hard. Do we need to push through a tough spot or chart a different path?

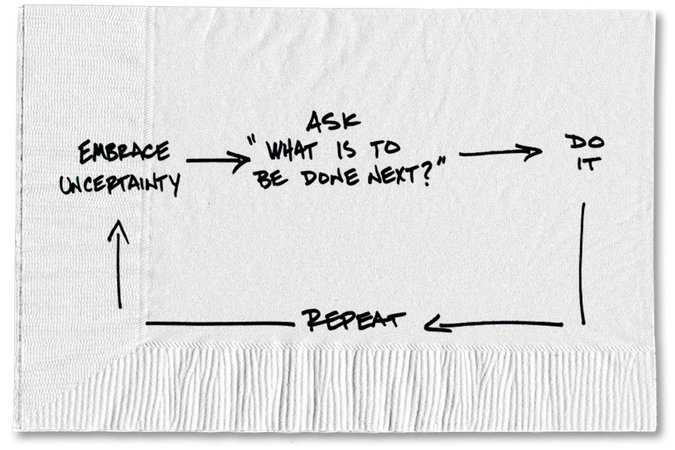

Right now, I’m working really hard on both having goals and accepting the reality of uncertainty. In fact, I embrace the uncertainty and say to myself, “Given that goal, and given the uncertainty, what’s to be done next?”

I repeat this process over and over. Every once in a while, I stick my head up and say, “I still want to head to that goal. Yes, I’m uncertain I’ll get there, but for now, I think that’s where I want to go.” Then, I put my head back down, figure out what’s to be done next and go do it.

Whatever the goal, we can learn to trust ourselves and deal with the reality of uncertainty. And for me that’s become the definition of true freedom.

About the author: For the last 15 years, Carl Richards has been writing and drawing about the relationship between emotion and money to help make investing easier for the average investor. His first book, “Behavior Gap: Simple Ways to Stop Doing Dumb Things With Money,” was published by Penguin/Portfolio in January 2012. Carl is the director of investor education at BAM Advisor Services. His sketches can be found at behaviorgap.com, and he also contributes to the New York Times Bucks Blog and Morningstar Advisor. You can now buy – “The Behavior Gap” by Carl Richard’s at AMAZON.

0 Comments