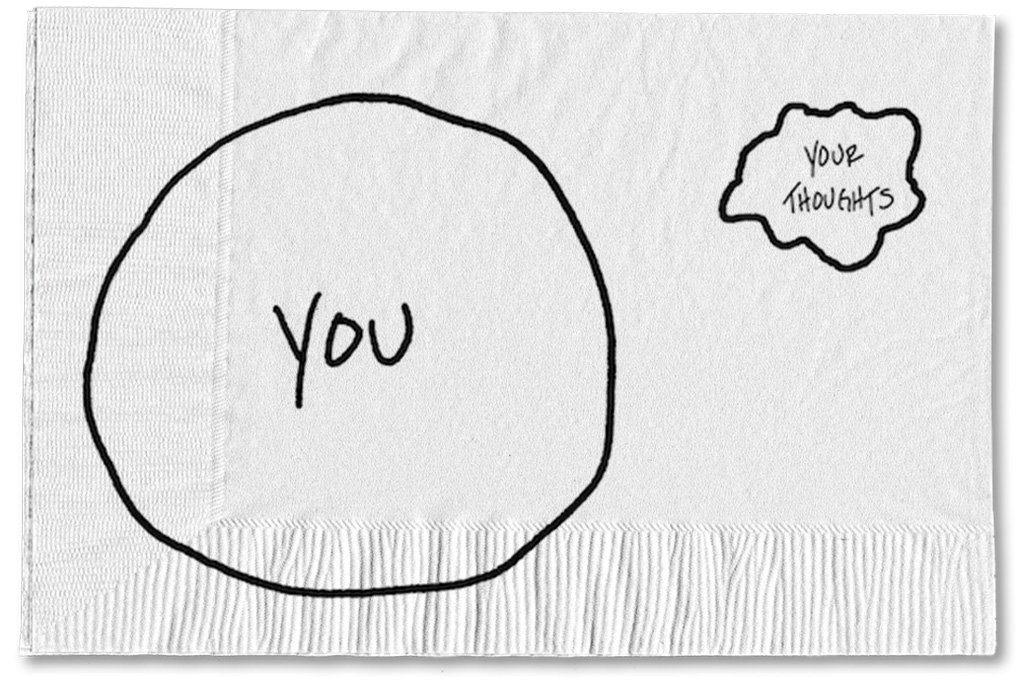

You are not your spending thoughts.

Spending without thinking about the long-term consequences is a problem. And by the long term, I mean just 30 days from now when the credit-card statement arrives. Some people label this type of spending “impulsive.” Others use the word “urge” to describe the feeling that comes just before they whip out the plastic.

There is no shortage of tips and tricks to help you control spending. You can cut up the credit cards, or just use cash and avoid having a debit card. You can even wear a wristband that will hit you with a little electric shockif you overspend.

All of these tactics focus on fighting the desire to spend, which might work for you. But I’ve found it even more helpful to concentrate on what’s taking us on this psychological journey in the first place.

It starts with the simple thought that you might want to buy something. You grab onto that thought instead of the one just before or after it. Once you give that spending thought a little attention, it gains strength and quickly becomes an urge, impulse or desire. The more you focus on it, the stronger it becomes, even if that focus is in the form of resistance or denial. It grows and then you act on it, because acting on it is easier than continuing to fight it. You repeat that process just a few times and then all of the sudden, you have a spending habit.

Yet it all started as a thought, and you are not solely the sum of your thoughts. There’s no reason you have to take that thought, to buy that thing, as a command. It’s just a thought. And just like the thousands before and after it, it will pass.

While it is natural to want a tip, trick, or app to help you let the thought pass, there’s really only one thing to do here. Start with the very next spending thought you have. See it for what it is, just a passing thought. Then repeat that process. With time, the intensity of the thoughts will diminish as you let them pass. And even when an occasional thought does feel overwhelming, you can sit tight with the knowledge that nothing bad has ever happened when you haven’t acted on those thoughts before.

The above blog is by Carl Richards originally published in The New York Times’ Blog.

About the Author: Carl Richards, a certified financial planner, is the author of “The Behavior Gap” and “The One-Page Financial Plan.” His sketches and essays appear weekly in the New York Times.

0 Comments