“You have to try tough love.”

“Don’t be an enabler.”

“I’m scared he won’t survive without my help.”

“We’re all doing the best we can.”

“We can’t afford that!“

“The heart has its reasons which reason knows nothing of.”

~ Blaise Pascal

I learned at a recent presentation on behavioral finance that the original economists were former WWII strategists, applying the same rationale and statistics/probabilities from war to how people make decisions about money. They assumed if everyone knew the “best” outcome they would simply – and certainly – choose that. Ha, ha! That’s so funny! Almost all of our financial decisions are made using some degree of emotion (yes, even my rational engineers do!).

Money gets to a tender place in all of us.

It touches so many areas of our lives, and resides in so many layers.

The trick, I think, is to find what drives your emotions (such as your values i.e. faith, justice, and harmony and needs i.e. security, comfort and understanding) so you at least know why you make the decisions you do…and then make the best choice you can based on those aspects of yourself.

For example, if you value your family, make decisions that will truly benefit your family, and try to define what that looks like so you can recognize it.

If you need security, what decision will make you feel more secure?

The wonderful Sarah Haykel lead a discussion about healthy boundaries at the “I HATE Budgeting (But I Like Having Money)” support group. In its simplest form, a boundary means identifying when and whyyou say, “yes” and when and why you say, “no.”

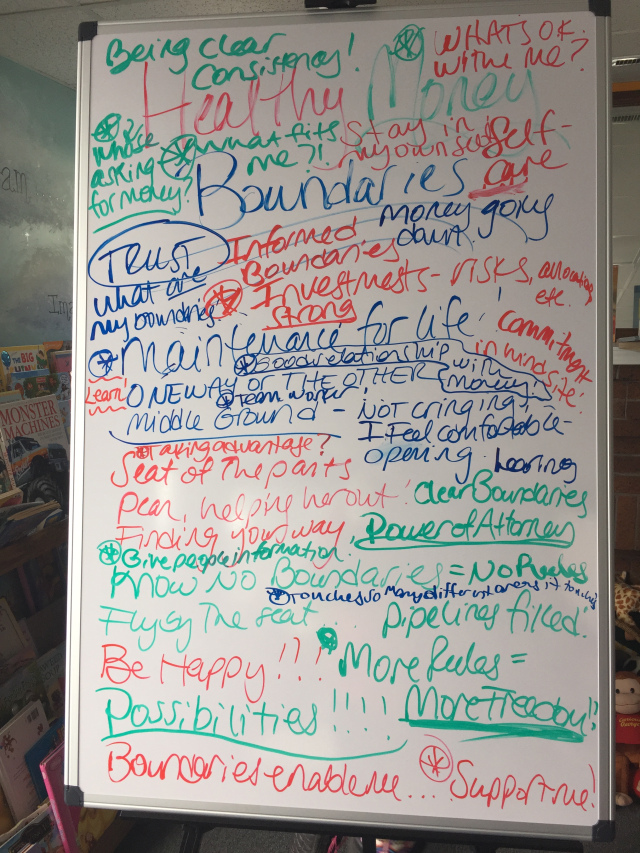

This is the white board indicating all the varied responses regarding boundaries.

If this photo overwhelms you, in brief, boundaries can be any and all of the following:

- Rules for living (note: emotions will ask – and even demand – that you to bend the “rules”)

- Limits (note: people we love will test our limits)

- Policies (that we establish when we’re calm and rational and not when we’re stressed and emotional)

- Supports (when we feel our decision is challenged)

- Permission (when we need to say, “No” but are afraid we’ll damage the relationship)

- Protection/Shields (When who we’re saying, “No” to is upset with us. Sarah says, “Preventative and proactive are protective.”)

- The Path of The Middle Way (From Zen Buddhism, to keep you from extreme overspending and extreme underspending, just like you cannot only inhale or only exhale, you must do both.)

- A means to understand and accept others’ boundaries while staying true to your own without judging – or fearing judgment. “He who would not forgive must judge, for he must justify his failure to forgive.” A Course in Miracles

I’ve blogged about some aspects of this topic in regards to creating a personal financial policy. For example, when you’ve been invited to the umpteenth in-home sales “party” (i.e. cooking gadgets, jewelry, purses etc.) you can reply, “It’s my policy not to attend sales parties.” Done.

Similarly, behavioral finance gurus Richard Thaler and Cass Sunstein coined the term choice architecture featured in their groundbreaking book, Nudge: Improving decisions about health, wealth, and happiness.

One of Sarah’s financial protection policies uses the metaphor of a parking ticket: don’t just put in the $1 you think will cover your time and risk getting a $30 ticket, put in $5 that will cover you in case you’re late.

Developing healthy boundaries can help us to feel free and content,

and can be a means where we can learn to trust ourselves;

to be consistent rather than conflicted.

What’s nice about boundaries or financial policies is that they’re flexible to deal with life’s changing circumstances. Tracking your expenditures gives you good data to create a policy or boundary and can be the foundation of a workable budget.

Side note: We meet upstairs from the cafe. At one point in our meeting, the smell of burnt toast permeated the air and distracted us from the conversation at hand. We all took it as symbol meaning there are times when we’re not paying attention to our finances and then something undesireable happens! Pay attention, don’t burn the toast!

Sarah shared her “Free to Be!” process:

And reminded us that, often when we’re afraid, we’ll hunch our bodies over in need of comfort and protection. Sarah instructed us in making a “Power Stance;” a position of authority and control that gets the powerful energy within us to direct our highest and best choices (think “Wonder Woman”).

In closing, these are some of the responses to the concept of boundaries:

- Annette: Research, decide, trust, let go.

- Sarah: Fluidity of cash flow, individualized and situational.

- Merridy: A tool for self-care.

- Bill: “If I’m serving enough, I don’t have to worry about money.”

- John: Everything in moderation.

- Heidi: The Power was there all along.

- Debbie: Money is a tool for intentional joy.

- Joy: Practicing Loving Kindness through blessing others with money.

- Ruthann: Not feeling stupid or regretting past decisions, feeling confident.

- Anne: Pause and consider the possibilities.

Can you see how joyful talking about money can be?! If you’re in WNY, join us!

The above blog is by Amy Jo Lauber originally published on her blog page.

About the author: My mission: I help people make good financial decisions with confidence. My purpose: I help people find peace with money. As President of Lauber Financial Planning, I provide financial advice, guidance and coaching on a fee only basis (no products, no commissions). I run a monthly support group called “I HATE Budgeting (But I Like Having Money)”, offer classes and seminars, speak around the world on the psychological, sociological, spiritual and emotional aspects of personal finance, and am the author of the ground-breaking book, “Living Inspired and Financially Empowered: Aligning Our Spiritual and Material Lives.”

0 Comments